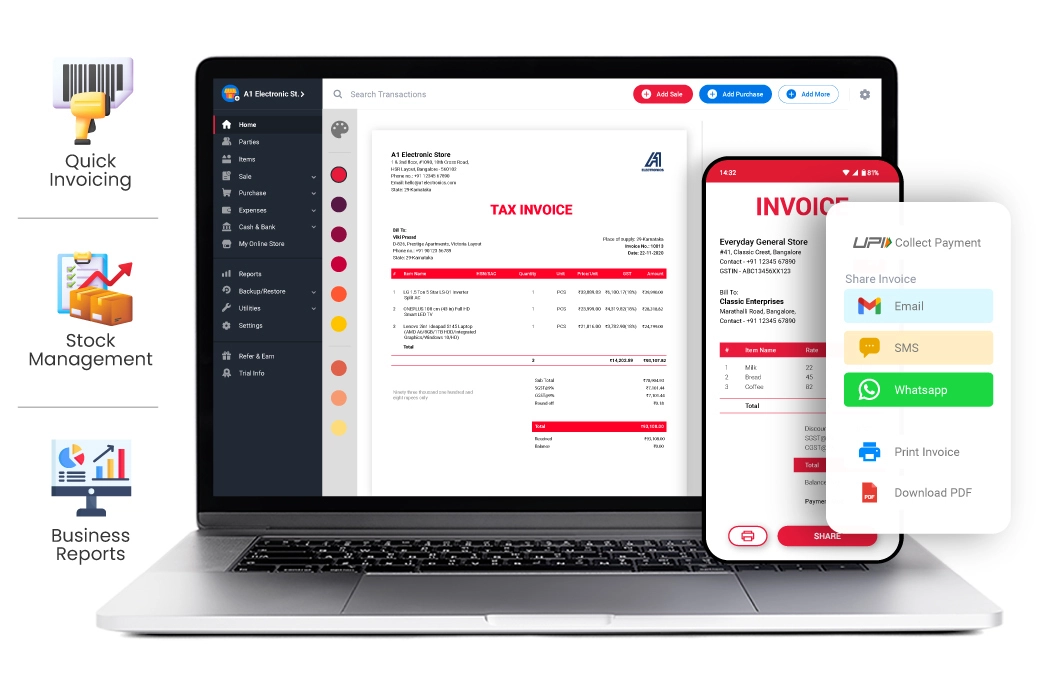

Looking for the Best Billing App for PC!

Take your business to the next level with Vyapar! Lifetime Free!

Create professional invoices in seconds, track income & expenses easily, and stay organized!

Vyapar is specifically designed to meet the unique demands of freelancers, helping you manage clients, track payments, and streamline finances effortlessly:

Vyapar For PC lets freelancers create professional invoices quickly and easily, with features like customizable templates, automated reminders, and secure online payment options.

Getting paid on time is crucial for freelancers. Vyapar For PC can create and send professional invoices, and track payments seamlessly, enabling integration with various payment gateways for efficient payment processing.

Freelancers often juggle multiple clients and projects, so keeping track of expenses can be a nightmare. Vyapar For PC allows you to easily categorize and record expenses on the go, ideally with receipt capture functionality, and integrating with bank accounts to automate expense recording.

This feature in Vyapar For PC helps in monitoring cash flow and ensuring accurate financial records.

Tax season can be a real headache for freelancers. While not all accounting software offers it, Vyapar For PC provides online accounting software for freelancers to calculate taxes automatically.

Vyapar For PC saves significant time and reduces errors with automated tax calculations, generation of tax reports, and reminders for tax deadlines.

Receivables and Payable

Payment Reminder

Multi-Model Payments

Share WhatsApp Greetings

Managing Finance Reports

Sale/Purchase Orders

Record Transactions

Mobile & Desktop Access

Share Visiting Card

Regular / Thermal Printer

With Vyapar For PC’s automatic backup feature, your data is consistently uploaded on Google Drive, avoiding loss of data from accidental deletions, hardware malfunctions, or other unexpected disasters.

Your vital business information remains secure, enabling swift recovery in the event of data loss. Easily configure automatic updates to suit your schedule and seamlessly restore data within minutes whenever needed using Vyapar For PC.

Expense management software allows businesses to track expenses related to inventory management in real-time. This includes purchases of raw materials, transportation costs, warehouse expenses, and any other expenses incurred in the process using Vyapar For PC.

Vyapar’s inventory management feature generates detailed reports on inventory expenses, offering insights into where money is being spent. These reports can include breakdowns of expenses by category, vendor, or time period, facilitating better cost analysis and decision-making with Vyapar For PC.

Unlock the potential of multi-device accessibility with Vyapar For PC licenses, enabling data access across single or multiple devices at your convenience.

Additionally, Vyapar business accounting software empowers you to establish and manage multiple companies, with the flexibility to create up to 5 firms within each entity. This capability enhances multi-location management efficiency, providing a comprehensive solution for your business needs using Vyapar For PC.

Focus on your business’s net current cash flow effortlessly with Vyapar For PC’s expense management app dashboard. With Vyapar, gain real-time insights into your business’s financial health, track the inflow and outflow of payments, and have the power to send payment reminders to customers, ensuring timely settlements.

With this proactive approach, you can navigate your organisation’s financial landscape with confidence and foresight using Vyapar For PC.

Vyapar For PC expense management software accelerates the creation of business transaction reports by automating data collection from various sources, including sales records, purchase invoices, and bank statements.

The app provides customizable templates, offers real-time reporting, integrates with financial systems, and enables analysis and insights with Vyapar For PC.

With access to comprehensive transaction details, business owners can make informed decisions on forecasting and budgeting to drive business growth effectively using Vyapar For PC.

Take your business to the next level with Vyapar! Lifetime Free!

Choosing the right expense management software is crucial for optimizing your business’s financial health. With numerous options available, it’s important to identify a solution that not only meets your current needs but also scales as your business grows. Here are several key points to consider when selecting the best expense management software for your organization:

Before diving into the myriad of software options, take a moment to evaluate how your business currently handles expenses. Understanding your existing processes will help pinpoint the specific challenges you face. Consider the following questions:

A: How Do Your Employees Generally Incur Expenses?

Do your employees use company credit cards, their personal cards, or a mix of both? If the latter is true, you’ll need software like Vyapar For PC that includes a mobile app feature. This allows employees to easily capture and submit receipts while on the go, streamlining the reimbursement process.

B: What Problems Do Your Employees Face While Reporting Expenses?

Employee feedback is invaluable. Engage with your team to identify any difficulties they encounter with the current expense reporting system. Understanding their challenges can guide you in choosing software that enhances their experience and improves compliance.

C: If You Are Re-Evaluating Your Current Software, What Features Are You Missing?

Assess your current software to identify any missing features that could optimize your expense management. Make a list of must-have functionalities, such as receipt scanning, reporting capabilities, and approval workflows, and eliminate unnecessary features that may inflate costs.

Establishing a budget for expense management software is essential. Analyze the costs involved and consider the potential return on investment (ROI). While an initial outlay may seem steep, investing in a robust solution like Vyapar For PC can yield significant long-term savings by reducing inefficiencies and automating tedious processes. Compare various software options to ensure you find a solution that provides great value without compromising on essential features.

Once you’ve identified your needs and budget, it’s time to research potential expense management software providers. To make an informed decision, evaluate each vendor based on the following categories:

A. Essential Features

As you explore software options, ask yourself, “Does this software provide all the necessary features?” Essential features may include:

B. Customization

Your chosen software should be adaptable to your organization’s evolving needs. Look for a solution that allows you to:

C. Positive User Experience

While functionality is critical, the user experience is equally important. For the software to be successful, employees must be willing to adopt it. Ensure that the selected software is:

Expense management software stores sensitive information about your employees and your business. Therefore, it’s crucial to select software with robust security measures in place. Look for a solution that:

In conclusion, investing in the right expense management software is a pivotal step toward enhancing your business’s efficiency and financial transparency. By considering your unique needs, setting a reasonable budget, thoroughly researching providers, and prioritizing user experience and data security, you can choose a solution that empowers your team and streamlines your financial processes. For a powerful, all-in-one option that meets these criteria, consider Vyapar For PC—a comprehensive tool designed to simplify expense management and drive business success.

Implementing expense management software can significantly streamline financial processes within your organization. Below are some of the key benefits that can help enhance your business’s efficiency and accuracy:

One of the most significant advantages of expense management software is the ability to gain real-time insights into company expenditures. The software interface presents all necessary information in an easy-to-understand format, often featuring graphs and charts for improved clarity. This real-time visibility not only allows for tracking fund movement but also ensures that once an expense claim is approved, the system updates all related data from payment initiation to the moment the recipient receives their funds.

Expense management software minimizes the risk of human error associated with manual data entry. In traditional systems, discrepancies may arise from duplicated entries, missing information, or even intentional manipulation of data. By automating processes and integrating seamlessly with your accounting system, expense management software ensures that your financial records remain precise and comprehensive, eliminating common pitfalls associated with manual entries.

Manually tracking employee payments, reimbursements, and invoices can be daunting, often leading to inaccuracies that complicate audits and accounting. Expense management software provides robust tracking of every cent spent, allowing for immediate identification of any discrepancies. Moreover, the software restricts data editing to authorized personnel, typically protected by strong passwords. This feature offers a high level of security against potential fraudulent activities, safeguarding your financial information.

Monitoring employee adherence to company spending policies can be challenging, especially when new policies are introduced. Expense management software automatically enforces compliance with spending guidelines based on your organization’s requirements. This ensures that the system remains updated with any new or revised policies, helping to maintain consistency and accountability in expense reporting.

When your expense management system is integrated with an enterprise resource planning (ERP) platform, submitting, tracking, and approving expense reports becomes much more efficient. This synergy benefits both managers and employees, leading to enhanced cash flow and productivity. By eliminating tedious, repetitive tasks, employees can dedicate more time to strategic initiatives like financial forecasting and planning, ultimately adding greater value to the organization.

Relying on paper documents can significantly slow down business processes. Managing physical records can be cumbersome, with risks of loss, misprints, or formatting issues. Expense management software removes the need for paper records altogether. All data is stored digitally, organized, and easily accessible, allowing for quick retrieval. Additionally, automated backups ensure that your information is secure and retrievable, contributing to both user-friendliness and environmental sustainability.

With expense management systems, employees can simply scan their receipts and submit claims digitally. Managers and approvers can review all necessary information effortlessly via a user-friendly interface. Once verified, the funds are transferred electronically to the employee, streamlining the reimbursement process. This eliminates the need for cumbersome paper reports, circulation for approval, and the hassle of lost receipts, simplifying the entire workflow.

Expense management software automates the claims submission and approval process, enabling users to complete these tasks with just a few clicks. Compared to traditional methods that require manual signatures and lengthy approval chains, the automated system offers real-time processing on a single platform, significantly speeding up operations and reducing hassle.

By leveraging the benefits of expense management software, businesses can optimize their financial processes, enhance accuracy, and improve overall productivity. With tools like Vyapar For PC, you can ensure that your expense management is not only effective but also aligns with your organization’s goals for growth and efficiency.

Creating a clear and professional expense policy is essential for effectively managing expenses within your organization. A well-defined policy allows for streamlined administration of expense reports, especially when integrated with expense management software.

To remain competitive and reduce operating expenses, businesses should invest in cutting-edge management software.

Expense automation can significantly enhance operational efficiency.

Keeping track of company spending can be challenging, even in ideal circumstances. Traditionally, businesses have relied on annual budgets, which can become outdated quickly.

By implementing these strategies, businesses can enhance their expense management processes, leading to improved efficiency, reduced costs, and better financial decision-making. With tools like Vyapar, you can ensure your expense management aligns with your organization’s growth and efficiency goals.

Expense Management software allows businesses to automate registering, monitoring, approving, and paying employees’ reimbursable expenses. In accordance with the company’s expenditure management policy, expenses management software ensures that the business pays appropriately on approved (or unapproved) expenses.

Expense management software offers several benefits:

1. Streamlined Expense Tracking

2. Improved Accuracy and Compliance

3. Real-Time Expense Visibility

4. Efficient Expense Reimbursement

5. Integration with Accounting Systems

6. Analytics and Reporting

7. Mobile Accessibility

8. Enhanced Policy Enforcement

Expense management software can automate several aspects of the expense reporting process, including receipt capture, expense report submission, and reimbursement approval. This simplification can save time and reduce the likelihood of mistakes and fraud.

You can use Vyapar software to manage your business expenses. Vyapar is easily compatible with other financial systems or accounting features required in your day-to-day operations. You don’t have to pay any money from your pocket to use our professional software.

Using the Vyapar expense management software, you can Perform various operations, such as creating reports. It allows you to create 37+ reports that provide insights into your spending and earning patterns. You can analyze the trend by using Vyapar’s generated reports.

Expense management software is utilised by businesses of all sizes, from startups to large enterprises, across various industries. It’s particularly helpful for finance departments, accounting teams, managers, and employees involved in expense tracking, reporting, and reimbursement processes. Even freelancers and independent contractors use it to keep track of business-related expenses for tax purposes.

Contact@Noor-k.com

Kalyar Traders, Wasu Rd, Mandi Bahauddin, Punjab Mandi Bahauddin, Punjab, Pakistan-50400